The 8-Minute Rule for Pvm Accounting

The 8-Minute Rule for Pvm Accounting

Blog Article

Fascination About Pvm Accounting

Table of ContentsNot known Details About Pvm Accounting Not known Details About Pvm Accounting Pvm Accounting for BeginnersPvm Accounting Fundamentals ExplainedThe Ultimate Guide To Pvm AccountingUnknown Facts About Pvm Accounting

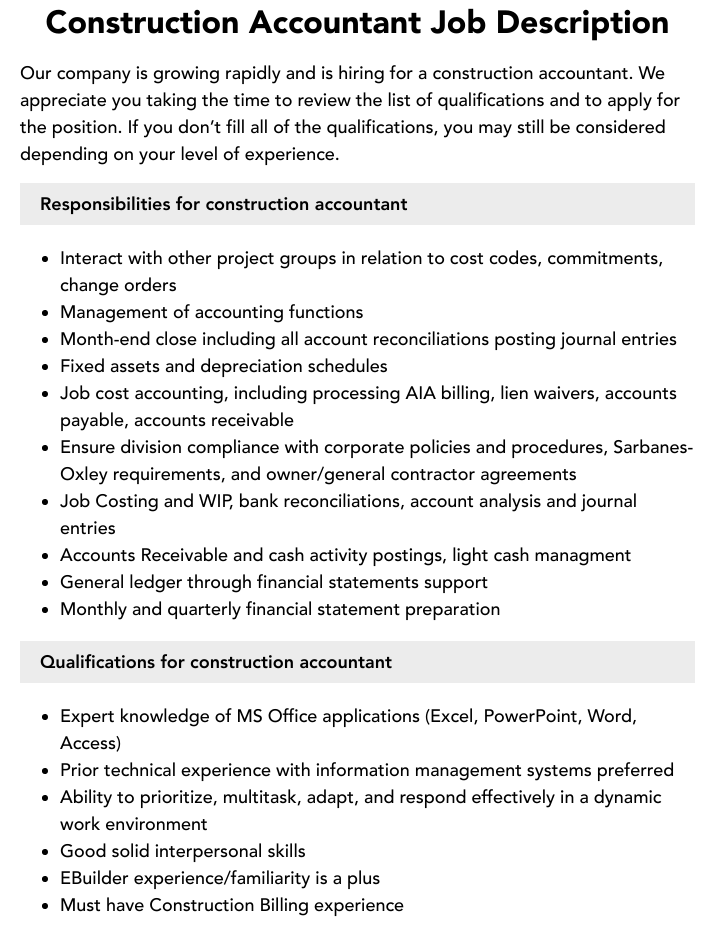

Supervise and handle the production and approval of all project-related payments to customers to foster good interaction and avoid issues. construction bookkeeping. Ensure that proper records and documentation are sent to and are updated with the IRS. Make certain that the bookkeeping procedure follows the legislation. Apply called for construction accountancy standards and procedures to the recording and coverage of building and construction activity.Understand and maintain typical price codes in the accounting system. Communicate with various funding companies (i.e. Title Firm, Escrow Company) concerning the pay application process and demands needed for repayment. Handle lien waiver dispensation and collection - https://www.evernote.com/shard/s508/client/snv?isnewsnv=true¬eGuid=4404e321-52ad-dbea-8eba-d5e975e5f179¬eKey=IAq1oFQVQ3PnblqtDRJ-taVHQRcX3dvb_wpCe3pFQx9ozoYePcYu7Prtow&sn=https%3A%2F%2Fwww.evernote.com%2Fshard%2Fs508%2Fsh%2F4404e321-52ad-dbea-8eba-d5e975e5f179%2FIAq1oFQVQ3PnblqtDRJ-taVHQRcX3dvb_wpCe3pFQx9ozoYePcYu7Prtow&title=The%2BUltimate%2BGuide%2Bto%2BConstruction%2BAccounting%253A%2BStreamline%2BYour%2BFinancial%2BProcesses. Display and fix financial institution issues including cost anomalies and inspect distinctions. Aid with executing and keeping internal financial controls and procedures.

The above statements are planned to define the basic nature and degree of job being executed by people designated to this category. They are not to be taken as an exhaustive listing of obligations, obligations, and skills needed. Employees might be called for to do tasks beyond their normal responsibilities every so often, as required.

Some Of Pvm Accounting

Accel is seeking a Building and construction Accountant for the Chicago Workplace. The Construction Accounting professional carries out a range of accountancy, insurance compliance, and task administration.

Principal obligations consist of, yet are not restricted to, dealing with all accounting features of the firm in a timely and exact manner and supplying reports and timetables to the company's CPA Company in the preparation of all economic statements. Ensures that all audit procedures and functions are handled properly. Responsible for all monetary documents, payroll, banking and everyday procedure of the accounting function.

Works with Project Managers to prepare and post all month-to-month billings. Produces regular monthly Job Cost to Date records and functioning with PMs to resolve with Project Managers' spending plans for each job.

Not known Facts About Pvm Accounting

Proficiency in Sage 300 Construction and Realty (formerly Sage Timberline Workplace) and Procore building management software program a plus. https://dzone.com/users/5145168/pvmaccount1ng.html. Need to likewise be competent in various other computer software systems for the prep work of reports, spread sheets and other audit analysis that might be needed by monitoring. construction bookkeeping. Have to possess strong business skills and capacity to prioritize

They are the monetary custodians that make sure that construction jobs continue to be on budget, abide with tax guidelines, and maintain monetary openness. Construction accountants are not simply number crunchers; they are tactical companions in the building and construction process. Their main duty is to manage the monetary facets of construction jobs, making certain that resources are designated successfully and financial dangers are minimized.

Pvm Accounting Things To Know Before You Buy

By maintaining a limited grasp on job finances, accountants aid stop overspending and monetary setbacks. Budgeting is a keystone of successful construction tasks, and building accountants are instrumental in this respect.

Navigating the complex internet of tax laws in the construction sector can be tough. Building and construction accountants are well-versed in these guidelines and guarantee that the project follows all tax needs. This includes handling payroll tax obligations, sales tax obligations, and any kind of other tax commitments particular to construction. To succeed in the role of a building and construction accountant, people need a strong educational foundation in accounting and financing.

In addition, accreditations such as State-licensed accountant (CPA) or Licensed Building And Construction Industry Financial Expert (CCIFP) more information are extremely pertained to in the industry. Working as an accounting professional in the building and construction sector comes with a distinct collection of obstacles. Building and construction projects typically entail limited target dates, changing policies, and unforeseen costs. Accounting professionals have to adjust promptly to these challenges to keep the project's financial health intact.

Pvm Accounting for Dummies

Ans: Construction accounting professionals develop and check budget plans, determining cost-saving chances and guaranteeing that the project remains within budget. Ans: Yes, construction accounting professionals take care of tax compliance for building jobs.

Introduction to Building And Construction Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building companies need to make tough choices amongst several economic choices, like bidding process on one job over another, picking funding for materials or tools, or setting a task's revenue margin. Building and construction is a notoriously unpredictable industry with a high failure price, slow time to settlement, and inconsistent cash money flow.

Production entails repeated processes with conveniently identifiable costs. Manufacturing requires various processes, products, and devices with varying prices. Each job takes location in a brand-new place with differing site problems and special challenges.

4 Easy Facts About Pvm Accounting Described

Frequent use of different specialized service providers and distributors affects efficiency and money flow. Repayment shows up in full or with routine repayments for the complete agreement quantity. Some part of repayment might be kept up until job completion even when the professional's work is finished.

Routine production and short-term contracts lead to convenient money circulation cycles. Irregular. Retainage, slow payments, and high upfront costs lead to long, uneven capital cycles - Clean-up bookkeeping. While standard makers have the advantage of controlled environments and maximized manufacturing processes, construction firms have to frequently adjust to every new task. Also somewhat repeatable tasks call for adjustments due to website problems and other variables.

Report this page